A Useful Alternative to a Traditional Cash Flow Statement: Cash Flow Waterfall

Make better business decisions using the waterfall to understand cash flow.

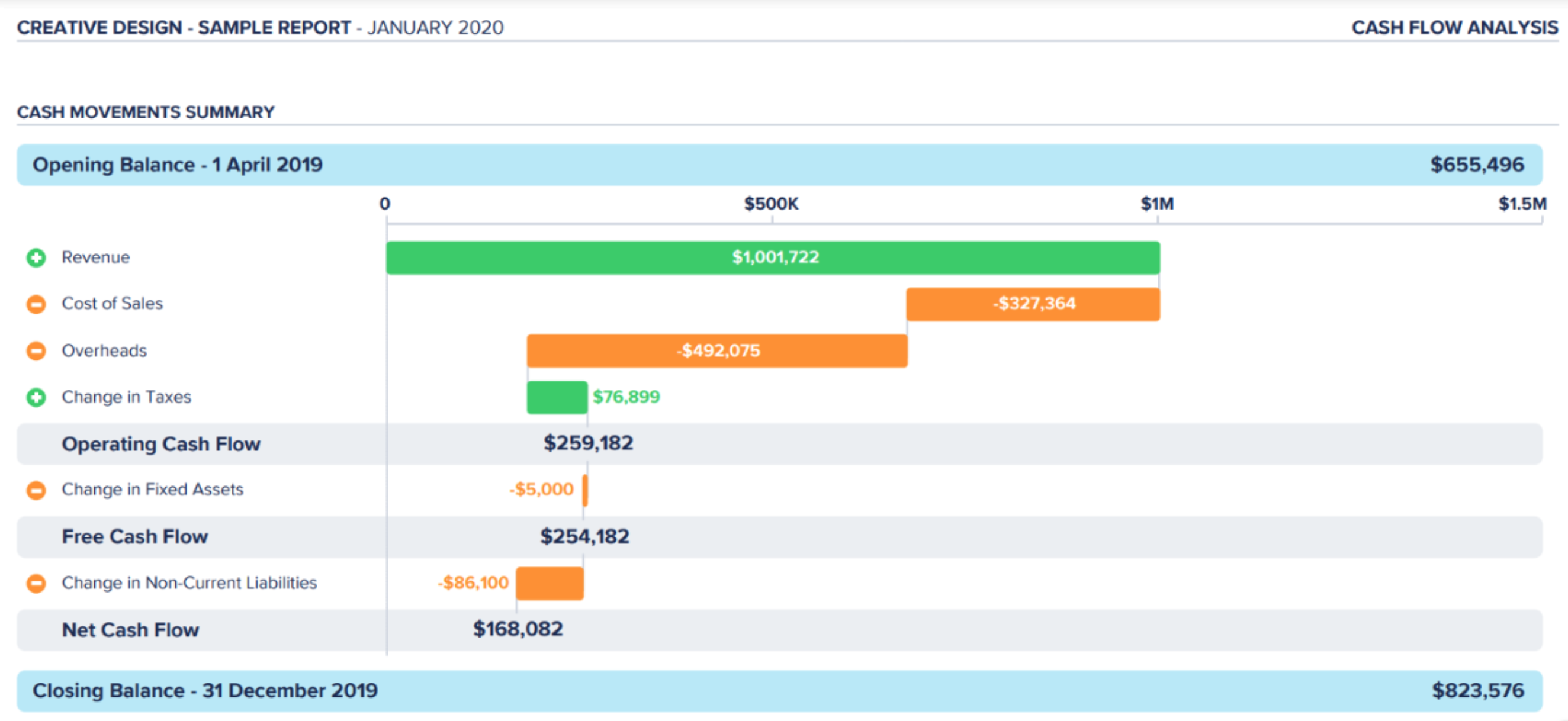

The cash flow waterfall is a helpful alternative to a traditional cash flow statement because it displays cash flow information graphically. Visually seeing cash inflows and outflows measured against each other is often a more intuitive way for non-accountant and accountants alike to glean insights from cash flow activities. I’ve provided an example to jump in:

This is a copy of a report of which the format is identical to Cash Flow Waterfall reports that we at Strata Cloud Accountants provide monthly and review with our clients to find insight, address surprises, and help make better business decisions.

Right off the bat, it is much more intuitive in that cash inflows are represented in green, and cash outflows are represented in orange. The goal of the waterfall report is the same as a standard cash flow (CF) report, to show how a business manages its overall cash flow in addition to standard operating results displayed on a profit and loss (P&L) report.

This report shows the business started with $655,496 on 1 April (top line opening cash balance) and finished with $823,576 on 31 December (bottom line closing cash balance). However, what is the story that this cash waterfall report tells? The first thing that jumps out is that business is operationally profitable. I know this by looking at the top 3 lines under “Opening Balance,” “Revenue,” “Cost of Sales” (COS), and “Overheads.” These items should be the same as those on the profit & loss report (P&L). However, in the cash flow waterfall report format, we can easily see that the green revenue inflows are larger than combined orange outflows of COS & Overheads.

What else affected cash flow besides the operational results represented in the first three lines?

Line 4, “Change in Taxes,” shows $76,899 as a green cash inflow, which is most likely an UNPAID tax liability owed. An important point to note is that green does not necessarily signal a good or bad thing. In this case, it just means you have $76,899 more in your bank account than a P&L would show because this amount may have been accrued as an expense but is not owed until the tax deadline. That is important because you would not want to assume the $76,899 is free cash or working capital that can be used for growth, investment, or another purpose. The last noteworthy thing is the $86,100 cash outflow represented as “Change” in “Non-Current Liabilities.” This would signal either a long-term debt paydown as part of either normal monthly payments, a one-time payment to reduce debt, or a combination of both. Either way, it is worth noting to ensure it makes sense with what you as a business owner were expecting. If this number is surprising, you can investigate and question further to make sure debt payments were recorded correctly.

Overall, my story for this cash flow waterfall might go:

“The business started with $655k cash in the bank, you were operationally profitable before tax for the period of about $180k, incurred $77k in additional tax liabilities to be paid, and paid down about $86k worth of debt to finish the period with $823k of cash in the bank. Is any of this surprising to you?” The final question is most critical. Assuming the accounting data is accurate, an owner or decision-maker must be able to explain these cash flow deviations. Our goal as advisors and accountants is to ask the right questions and guide the decision-maker in finding the answers.

We value accounting freedom achieved through exceptional customer service and extraordinary financial insights. Check out the services we offer to help you make better business decisions and learn more about our talented team.

By Kyle Smith, CPA