Cashflow Tips for Leveraging Your Float

Cashflow Tips

I’ve spent time working for various companies in accounts receivable as a Controller. One of the most immediate ways I’ve seen business owners maximize cash on hand is to leverage cash float. Cash float means proactively working with major customers to get paid as quickly as possible and at the same time extending payment terms with your suppliers to help your business’s cash flow projections.

- Consider taking Cost of Goods vendors off autopay: Setting autopay can be a good thing for your personal finances, but when it comes to your business, there are certain vendors, for positive cashflow purposes, that you may not want to set up this way. Your major direct suppliers are a prime example. By taking major suppliers off of autopay, you’ll have more control over the bank or credit card account they were using. You can also spot an incorrect or over-order before the funds are drawn from your account. That way, you can communicate any issues with the supplier directly before any cash surprises and pay when you’re ready (within the supplier’s net terms, of course).

- Get on terms with major suppliers ASAP: Even though this may take a bit more work (especially on the front end), getting on payment terms pays direct dividends (extra cash) for your business. For clarity, getting set up on terms means paying your suppliers within a set period instead of COD (cash on delivery). So if your business has “net 30” terms with a supplier, it means you must pay the supplier within 30 days of the original bill date.

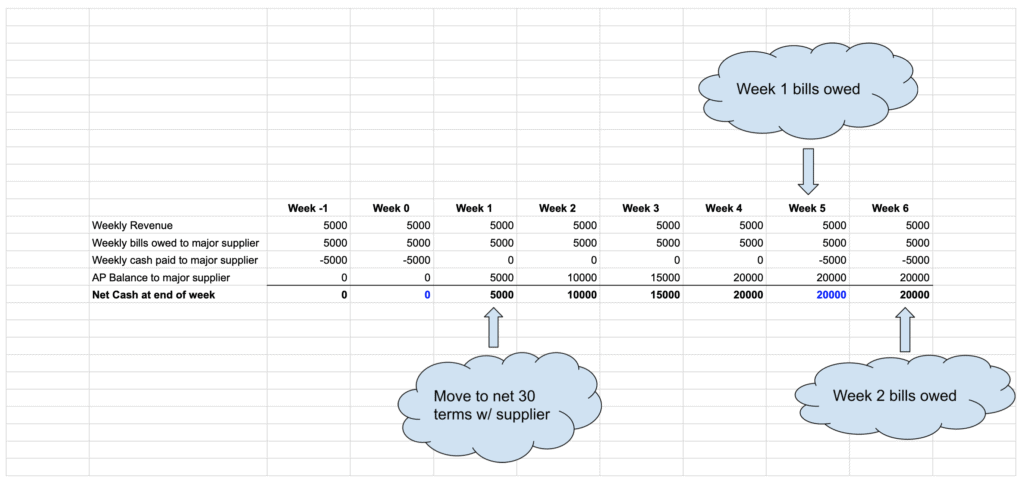

To illustrate how getting on terms benefits cashflow, on a Financial Cashflow statement, there is a section called “Change in Payables,” which measures the change in your short-term Accounts Payable liability to your vendors/suppliers. If this number goes up, it means you’ve kept cash in your pocket instead of paying it out. Conversely, if the number decreases, it means you’ve paid out more money to vendors that you’ve received in new bills. So say you’re paying a major vendor with auto-pay and are averaging $5k/week in orders to them. If you ask them to extend the net 30 terms and succeed, you’ve just put an extra $20k in your business’s pocket. And that is free cash to help expand operations, pay off lingering start-up costs, or take care of whatever is the highest priority.

If you trust my assertion above, skip to tip #3 below, otherwise see this explanation breakdown: “But wait…” you might say, “I still have to pay that vendor eventually once I hit the 30 day due date”. You’re correct but think about the “Change in Payables” referenced above for the month you were able to get on terms with the supplier: At the end of week 1, you would have previously paid out $5k to your major vendor in that week, however now you are on net 30 terms, and the bills are not due for another 23 days (net 30 – 7 days week). Follow this process, by the end of week four, you would have had as many weeks where you would have not yet had to pay, accumulating $20k in extra working capital (cash). The original week 1 payable of $5k would also be coming due, so you will outlay $5k to remain current per net 30 terms; but you will also have another fresh week of bills that you will not have to pay for another 30 days.

So you have just granted yourself a month of not outlaying $5k/week to your major supplier, and will have resumed paying only the original $5k (assuming your orders are consistent week-to-week) after the first 30 day period has passed. Assuming your business remains on consistent net 30 terms with the major supplier for the future (a very reasonable assumption, assuming you keep to the agreement), you will continually keep that initial boost in cash from moving off COD to the net 30 terms. See table insert that illustrates this process:

- Reduce terms with major customers ASAP: Using the exact same logic as above, assume you can work with a customer who was paying net 30 to start paying on receipt. If you’re averaging $5k/week in sales to this vendor, you will again put $20k into your business’s pocket, and combined with your supplier terms work, you would have added $40k in free cash by the end of the month! And depending on how beneficial it is to have the cash in hand, you can consider offering a discount for suppliers to pay sooner in order to provide an additional incentive.

Summary: the scenarios given above may be simplified examples; however, they illustrate how important it is to work with vendors to extend terms and with customers to bring payment terms down to generate cash. And the old saying “cash is king” is truly apt when it comes to your business because more cash on hand provides more flexibility and freedom to efficiently maintain or grow and expand operations.

By Kyle Smith, CPA